Best Ways to Save Tax in India for Salaried Employees (with Examples)

If you are a salaried employee in India, tax-saving is probably something you think about every year — especially during the last few months of the financial year when your HR asks for investment proofs.

Thankfully, the Indian government provides many ways to reduce your taxable income legally. By planning smartly, you can save thousands of rupees every year and increase your take-home salary.

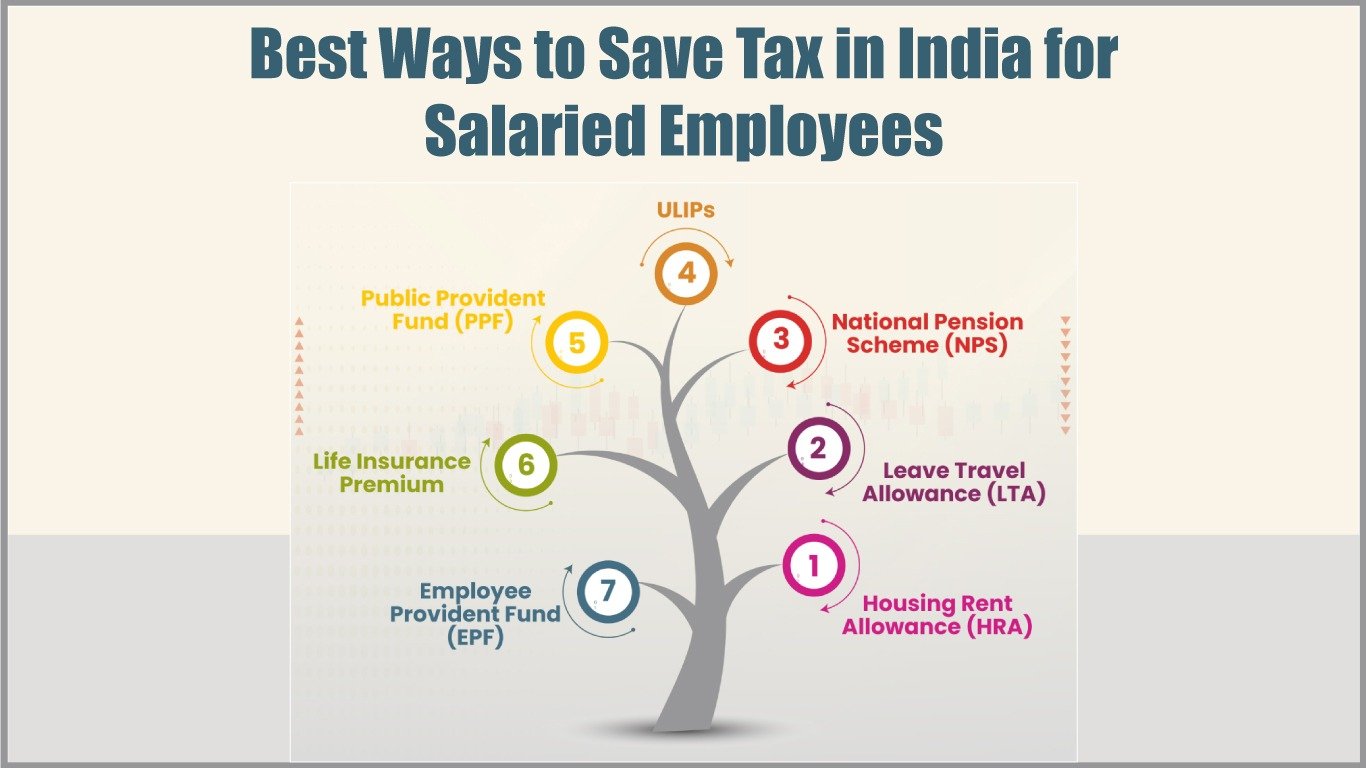

In this article, we will discuss the best ways to save tax in India for salaried employees, along with easy examples to help you understand.

1. Use Section 80C (Up to ₹1.5 lakh deduction)

This is the most common and popular section for tax saving. You can claim a deduction of up to ₹1.5 lakh under Section 80C by investing in various instruments.

Options under 80C:

- Employee Provident Fund (EPF) – automatically deducted from your salary.

- Public Provident Fund (PPF) – long-term savings with tax-free interest.

- Life Insurance Premiums – for self, spouse, or children.

- Tax-saving Fixed Deposits (5-year lock-in).

- Equity Linked Saving Scheme (ELSS) – mutual funds with tax benefits.

- National Savings Certificate (NSC).

Example:

If your salary is ₹10,00,000 per year and you invest ₹1.5 lakh in PPF + ELSS + life insurance, then your taxable income becomes:

₹10,00,000 - ₹1,50,000 = ₹8,50,000

2. Take Advantage of Section 80D (Health Insurance)

Under Section 80D, you can claim a deduction for premiums paid for medical insurance.

- Up to ₹25,000 for self, spouse, and children.

- Extra ₹25,000 if you pay for your parents' health insurance (₹50,000 if they are senior citizens).

Example:

You pay ₹20,000 for your own health insurance and ₹30,000 for your senior citizen parents. Then you can claim:

₹20,000 (self) + ₹30,000 (parents) = ₹50,000 deduction

3. Use House Rent Allowance (HRA)

If you live in a rented house and get HRA as part of your salary, you can claim exemption under Section 10(13A).

How much is the HRA exemption?

The least of the following is exempt:

- Actual HRA received

- 50% of salary (metro cities) or 40% (non-metro)

- Rent paid minus 10% of salary

- Basic Salary: ₹40,000/month

Example:

- Rent paid: ₹15,000/month

- HRA received: ₹18,000/month

Your exempt HRA = minimum of:

- ₹2,16,000 (18,000×12)

- ₹2,40,000 (50% of 40,000×12)

- ₹1,80,000 (15,000×12 – 10% of salary)

So, you can claim ₹1,80,000 HRA as tax-free.

4. Standard Deduction (Flat ₹50,000)

This is a default deduction for all salaried employees. No investment or proof is required.

Since FY 2019-20, every salaried person gets a ₹50,000 standard deduction automatically from their income.

Example:

If your salary is ₹8,00,000, it becomes:

₹8,00,000 - ₹50,000 = ₹7,50,000 (taxable)

5. National Pension System (NPS) – Extra ₹50,000 under 80CCD(1B)

Apart from ₹1.5 lakh under Section 80C, you can invest ₹50,000 more in NPS under Section 80CCD(1B).

This is in addition to 80C, so your total deduction becomes ₹2,00,000.

NPS is a good option for retirement planning.

Example:

You invest:

- ₹1.5 lakh in ELSS under 80C

- ₹50,000 in NPS under 80CCD(1B)

Then your total deduction = ₹2,00,000

6. Home Loan Benefits (Section 24 + 80C)

If you have a home loan:

- You can claim up to ₹2 lakh per year on interest under Section 24(b).

- You can also claim principal repayment under 80C (part of ₹1.5 lakh limit).

Example:

You paid:

- ₹1.8 lakh interest

- ₹1.2 lakh principal

Then:

- ₹1.8 lakh is deductible under 24(b)

- ₹1.2 lakh under 80C

7. Tax-free Components in Salary

You can ask your employer to include some tax-free allowances in your salary structure:

Examples:

- Meal Coupons (like Sodexo) – up to ₹2,200/month tax-free

- Mobile and Internet Reimbursements

- Books & Periodicals Reimbursement

- Leave Travel Allowance (LTA) – for travel within India (twice in 4 years)

These can reduce your taxable salary if used smartly.

8. Education Loan Interest – Section 80E

If you have taken an education loan (for yourself, spouse, or children), the interest paid can be claimed as a deduction under Section 80E.

No upper limit, but only for 8 years.

9. Donations – Section 80G

Donating to eligible charities or relief funds allows you to claim 50% to 100% deduction under Section 80G.

Make sure to:

- Donate to registered organizations

- Pay via cheque, UPI, or card (not cash)

- Keep the receipt

10. New vs Old Tax Regime

From FY 2020-21, India has two tax regimes:

- Old Regime – allows all deductions (80C, 80D, HRA, etc.)

- New Regime – lower tax slabs but no deductions allowed.

You can choose every year which one is better for you.

Example:

If you have high deductions (80C + HRA + 80D + NPS), old regime is better.

If you have no investments or deductions, then new regime may offer lower tax.

Final Tips:

- Start planning your investments from April, not in March.

- Use tools like tax calculators on websites like Cleartax or Income Tax India.

- Keep digital records of receipts, insurance, rent agreements, etc.

- If confused, consult a tax expert or CA.

Conclusion

Saving tax is not just about last-minute investments — it's about smart yearly planning. As a salaried person in India, you can reduce your tax burden using government-approved methods like 80C, NPS, HRA, and health insurance.

Make the most of these benefits, and enjoy more savings in your hands!