How FII and DII Activity Affects Retail Investors and Their Investment Strategy

Have you ever wondered why the stock market swings up and down so much? One big reason is the activity of big investors—Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII). These are the market’s heavyweights, and their moves can make a huge difference in stock prices. But what does this mean for you as a retail investor? Should you follow their moves, or is there a smarter way to invest? Let’s break it down in simple terms.

What Are FIIs and DIIs?

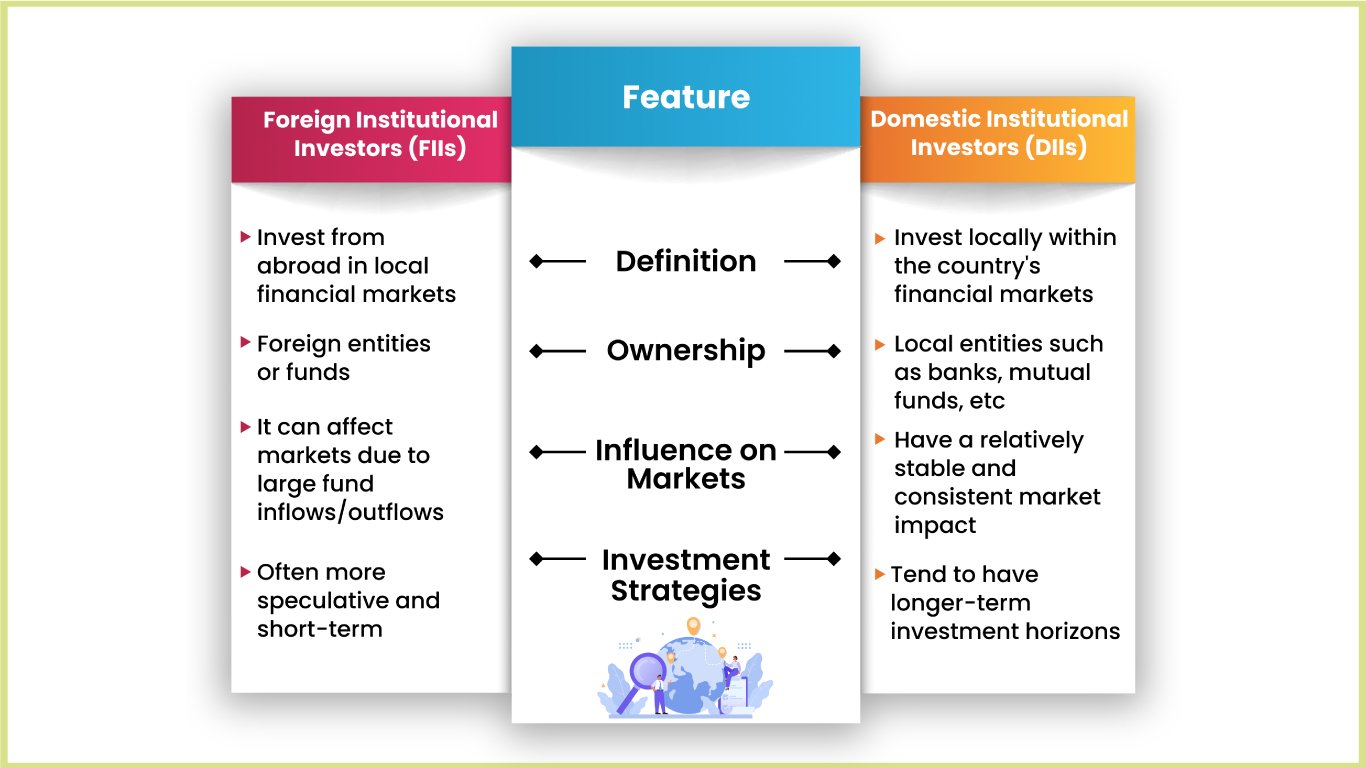

Before we dive deep, let’s understand what these terms mean:

-

Foreign Institutional Investors (FII): These are big investment funds, hedge funds, mutual funds, or pension funds from outside India that invest in our stock market. They often bring in large amounts of money, but they can also withdraw quickly based on global factors.

- Domestic Institutional Investors (DII): These are investment firms, insurance companies, and mutual funds based in India that invest in Indian stocks using money collected from Indian investors. They usually have a long-term perspective and provide stability to the market.

Both FIIs and DIIs have the power to move the market, but their strategies are often different. Understanding their behavior can help retail investors make better financial decisions.

How Do FIIs and DIIs Influence the Market?

1. They Decide the Market’s Mood

Imagine the stock market like a party. When FIIs invest heavily, it’s like a flood of guests arriving, making the party (market) lively and exciting. Stocks go up, and everyone feels optimistic. But when they start leaving, panic sets in, and the market crashes. DIIs, on the other hand, act like responsible hosts who try to keep things in order, buying stocks when FIIs sell and stabilizing the market.

2. Stock Prices React to Their Moves

FIIs usually invest in high-growth stocks. When they buy, stock prices surge, and when they sell, prices drop. DIIs, however, invest in more stable companies and often buy when prices fall, providing support. This is why some stocks suddenly rise or fall without any major company news—it's often just FII and DII activity at play!

3. Market Volatility – The Rollercoaster Ride

Since FIIs react to global events, like U.S. interest rate hikes or geopolitical tensions, their buying and selling decisions can be unpredictable. This creates volatility—markets swing up and down rapidly. Retail investors often get caught in this storm, panicking when prices drop and buying when the market is already high.

4. Liquidity – More Money, More Action

FIIs bring in foreign currency, making the stock market more liquid. This means stocks are traded actively, making it easier for investors to buy and sell. However, when FIIs exit, liquidity dries up, and stock prices can become unpredictable.

5. Sector-Specific Influence

FIIs love high-growth sectors like banking, IT, and pharma. DIIs, on the other hand, prefer stable sectors like FMCG and utilities. If you see FIIs aggressively buying a certain sector, it may be trending. But remember, they can exit anytime, causing sharp declines.

What Should Retail Investors Do?

1. Follow Their Moves, But Don’t Blindly Copy

Tracking FII and DII activity is smart, but blindly following them can be risky. They have different investment horizons and risk appetites compared to individual investors. Instead, use their trends as indicators and combine them with your research.

2. Avoid Panic Selling When FIIs Exit

Many retail investors sell stocks when they see FIIs withdrawing. But DIIs often step in to balance the market. Instead of panic selling, analyze why FIIs are exiting. If it's due to external reasons (like global economic trends) rather than company fundamentals, you might be better off holding onto your investments.

3. Use DII Buying as a Confidence Signal

DIIs have a long-term outlook. If they are buying when the market is falling, it’s usually a good sign. They invest based on strong fundamentals, so following their moves can be a good strategy.

4. Diversify Your Portfolio

Since FII investments are unpredictable, don’t put all your money in FII-favored stocks. Diversifying across different sectors and assets (like mutual funds, gold, or real estate) can protect you from extreme volatility.

5. Think Long-Term

Short-term FII movements cause market ups and downs, but long-term growth depends on economic fundamentals. Focus on investing in strong companies rather than reacting to daily market movements.

Real-Life Examples

- 2020 Market Crash and Recovery

- When COVID-19 hit, FIIs withdrew billions of dollars, causing a market crash.

- DIIs and retail investors bought at lower prices, leading to a strong market recovery by the end of 2020.

- FII Selling in 2022 Due to U.S. Rate Hikes

- FIIs sold heavily in 2022 when the U.S. raised interest rates.

- DIIs continued investing in Indian stocks, preventing a deeper crash.

Final Thoughts

FIIs and DIIs influence the market in a big way, but retail investors shouldn’t blindly follow them. While FIIs bring money and volatility, DIIs provide stability. Understanding their behavior can help you make informed investment decisions. Instead of reacting emotionally to market movements, focus on long-term wealth creation.

So, next time you see headlines about FIIs pulling out money or DIIs buying aggressively, don’t panic. Use this information wisely, stay patient, and build a strong investment portfolio that suits your goals!