AI vs. Manual Processing: Which is Better for Reconciliation?

Reconciliation is one of the most important activities for any business. Whether it’s a bank, an e-commerce platform, or even a small retail shop, every business needs to check its records and ensure everything matches correctly. This process makes sure that money coming in and going out is accurate, and it helps detect mistakes, fraud, or missing entries.

Traditionally, reconciliation has been done manually. Accountants and finance staff spend hours going through spreadsheets, invoices, and bank statements to make sure that all transactions match. But in recent years, Artificial Intelligence (AI) has entered the field. Many companies now use AI-powered tools to automate reconciliation and reduce errors.

This brings us to a big question: Which is better for reconciliation—AI or manual processing? Let’s explore both methods, their pros and cons, and when each one makes the most sense.

What is Reconciliation?

Reconciliation simply means comparing two sets of records to ensure they match.

For example:

- A business may compare its accounting records with bank statements to make sure all deposits and withdrawals are correct.

- An online store may compare customer payments with invoices to ensure no payment is missed.

- A bank may compare transactions across different systems to ensure accuracy.

Reconciliation is vital because it helps businesses:

- Detect errors before they grow into big problems,

- Prevent fraud,

- Stay compliant with financial regulations,

- And maintain trust with customers and partners.

Now that we understand the meaning, let’s look at the two main approaches—manual and AI-powered reconciliation.

Manual Processing in Reconciliation

Manual reconciliation means people perform the checks themselves without much automation. Accountants or finance staff review records line by line, often using spreadsheets, and match transactions carefully.

Advantages of Manual Processing:

- Human judgment: People can use their experience and intuition to catch unusual transactions that a machine might miss.

- Flexibility: For small businesses with fewer records, manual work is often simple and effective.

- Sense of control: Managers sometimes feel more confident when humans are directly handling the records.

Disadvantages of Manual Processing:

- Slow and time-consuming: Going through hundreds or thousands of transactions can take hours or even days.

- Prone to human errors: Mistakes in typing, copying, or comparing numbers are common.

- Costly for large businesses: As the volume of transactions grows, companies need more staff, which increases costs.

- Repetitive and stressful: Employees may lose motivation doing the same checking work every day.

Manual reconciliation works well in small setups, but it becomes inefficient and expensive as transaction volumes increase.

AI in Reconciliation

Artificial Intelligence (AI) uses smart algorithms and automation to handle reconciliation tasks. Instead of people reviewing each line, AI software can scan invoices, payments, and transactions in bulk and highlight mismatches almost instantly.

For example, an AI tool can automatically:

- Read invoices,

- Compare them with payment records,

- Spot mismatches,

- And even suggest corrections or flag possible fraud.

Advantages of AI in Reconciliation:

- Speed: AI can process thousands of transactions in minutes, which saves a huge amount of time.

- High accuracy: Unlike humans, machines don’t get tired or distracted. They produce more consistent results.

- Scalability: AI can easily handle growth in business volume without needing more staff.

- Fraud detection: AI can analyze patterns and identify suspicious activity faster than humans.

- 24/7 availability: AI systems can work all day and night without breaks.

Disadvantages of AI in Reconciliation:

- High initial cost: Buying and setting up AI tools can be expensive for small businesses.

- Training required: Employees need time and training to adapt to AI systems.

- System dependency: If the system crashes or malfunctions, work may stop until it is fixed.

- Limited human judgment: AI follows patterns and data but may not handle special or unusual cases as well as people can.

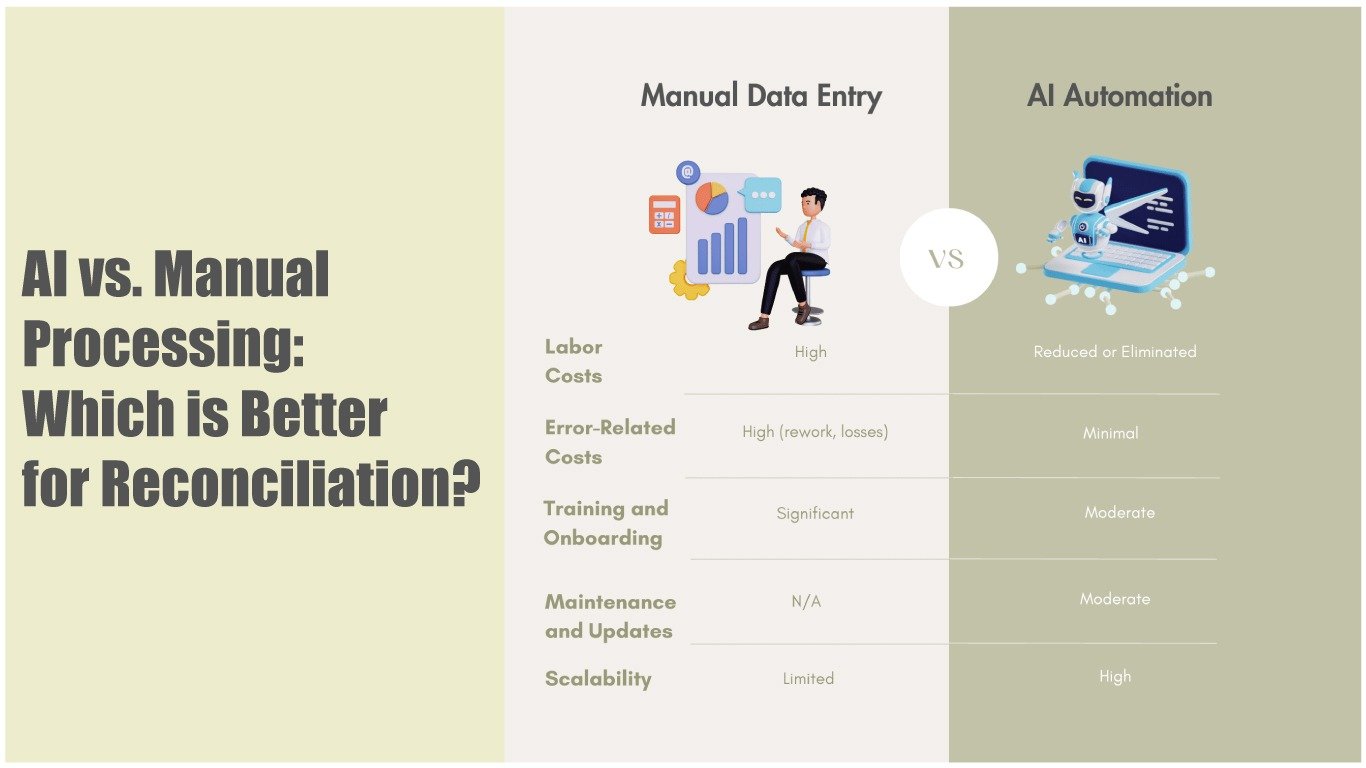

AI vs. Manual Processing: The Comparison in Words

When we compare manual processing with AI-based reconciliation, the differences are clear.

Manual reconciliation is slow and prone to errors, especially when businesses deal with thousands of transactions. It requires a lot of human effort, and employees often spend long hours on repetitive tasks. However, manual processing has one advantage—it allows human judgment. A person can look at a transaction and think, “This doesn’t look right,” based on experience.

AI, on the other hand, is built for speed and accuracy. It can process massive volumes of data in a fraction of the time and with fewer mistakes. For growing businesses, this is a huge benefit because they don’t need to keep hiring more people to handle the workload. AI is also great at detecting patterns of fraud or unusual behavior. However, it lacks the “gut feeling” or experience-based judgment that humans bring.

In short, manual reconciliation is more flexible for small-scale or special cases, while AI is much better for large-scale, repetitive, and high-volume tasks.

When is Manual Reconciliation the Better Choice?

Manual reconciliation is not completely outdated. It still makes sense in some cases:

- Small businesses: If your company has only a few dozen transactions per month, manual checks are often enough.

- Unique transactions: Some businesses deal with very irregular or special cases that AI tools may not understand.

- Budget limits: Companies that cannot invest in AI tools may stick to manual methods.

When is AI Reconciliation the Better Choice?

AI works best in scenarios where speed and scale matter the most:

- Large businesses: Companies with thousands of transactions daily need AI to save time and reduce cost.

- Banks and financial firms: Accuracy is non-negotiable, and AI helps avoid mistakes that could lead to heavy losses.

- E-commerce platforms: Online businesses handle millions of payments, refunds, and invoices—AI makes this possible.

- Industries at risk of fraud: AI’s ability to detect unusual patterns helps prevent fraud quickly.

The Hybrid Approach: Combining AI and Human Judgment

The best solution for many companies is a hybrid model. In this approach, AI takes care of the bulk work—scanning transactions, matching records, and flagging mismatches. Humans then step in to review the exceptions, handle special cases, and approve the final reconciliation.

This approach saves time, ensures accuracy, and still allows human judgment where it is necessary. Employees also feel more engaged because they focus on meaningful work instead of repeating the same task every day.

The Future of Reconciliation

The future of reconciliation will be largely AI-driven. With advancements in machine learning and predictive analytics, AI will not only reconcile past transactions but also predict future mismatches.

Imagine an AI tool warning you before a mismatch even happens:

- “This payment may fail to match with the invoice next week due to missing details.”

That is where reconciliation is heading. Manual processing will still exist, but mainly as a supporting role. AI will do the heavy lifting, while humans will step in only for complex cases or decision-making.

Conclusion

So, which is better for reconciliation—AI or manual processing?

The answer depends on the size and needs of your business.

- For small businesses with limited transactions, manual reconciliation can still be practical and affordable.

- For medium and large businesses, AI is clearly the smarter choice because it saves time, improves accuracy, and reduces costs in the long run.

- In reality, the best solution is often a combination of both. AI handles the heavy work, while humans use their judgment for exceptions and final checks.

At the end of the day, reconciliation is all about building trust. Whether you use manual processes or AI, your main goal should always be the same: accurate, reliable, and timely financial records.